Transform Your Preparation

Weekly Mentorship from the Founder

(Ashok Yadav) of CrackGradeB!

64,000

YOUTUBE

FOLLOWER

300+

STUDENT

SELECTIONS

90%

QUESTIONS

HIT RATIO

100%

SYLLABUS

COVERAGE

Courses

Experience excellence!

Our faculty ensures

100% preparation for all.

.png)

Availability of Quality Content

Comprehensive Syllabus Coverage

Highest Question Hit Ratio

Important Updates/ Notifications

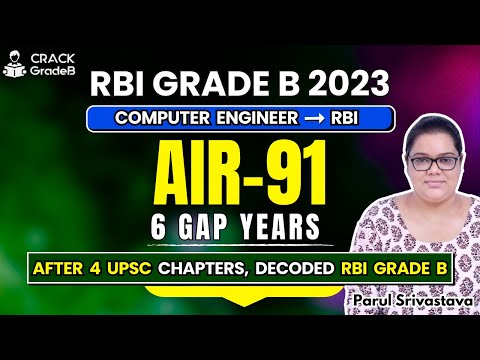

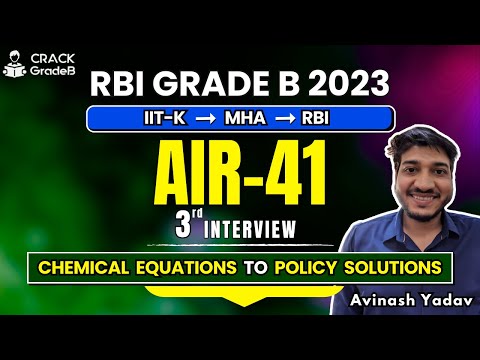

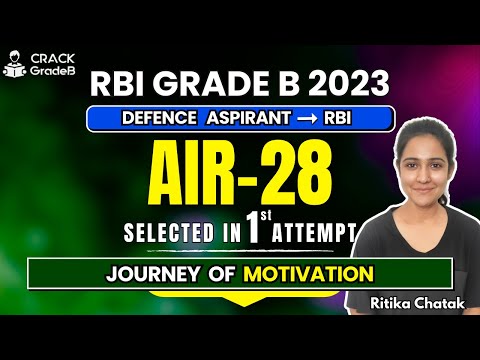

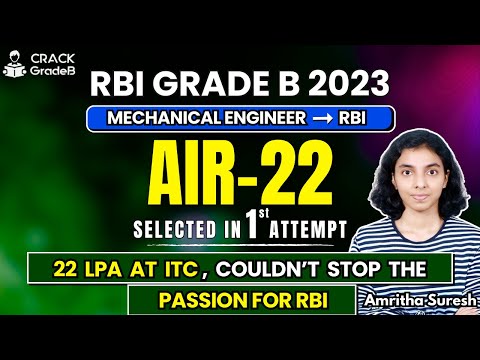

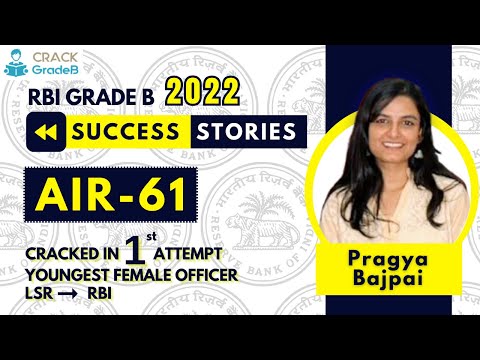

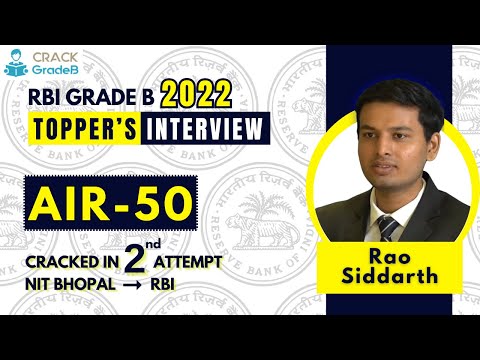

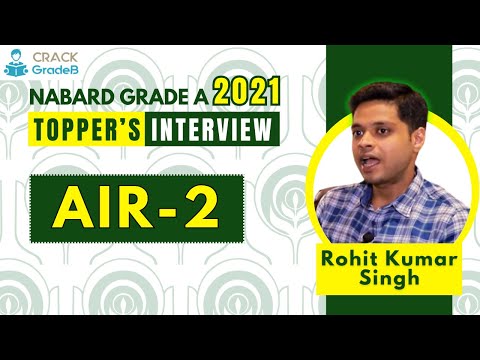

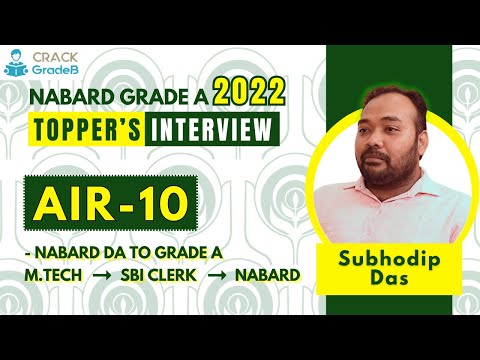

Hear it from our

successful students

Frequently asked Questions

- Minimum age limit: 21 years

- Maximum age limit for General: 30 years

- Graduation in any discipline /Equivalent technical or professional qualification with minimum 60% marks (50% for SC/ST/PwBD applicants)

- or Post-Graduation / Equivalent technical qualification with minimum 55% marks (pass marks for SC/ST/PwBD applicants) in aggregate of all semesters / years.

- or Candidates who have passed the Final Examination for Membership of the Institute of Chartered Accountants of India may also apply for the post.

- or Any such full-time course from a recognised University / Institute that is taken after graduation and is at least of 2 years’ duration / recognised by the Government as equivalent to post graduation will be eligible for admission to the examination.

Candidates belonging to unreserved i.e. General Category, who have already appeared Six times for Phase-I Examination for this post/s in the past, are not eligible to apply. No such restriction applies to candidates belonging to SC/ST/OBC/PwBD/EWSs, if the posts are reserved for them.

Selection for the RBI Grade B posts will be done through ONLINE examinations in Phase - I and Phase - II and interview.

Phase I: Preliminary Exam

This will comprise a single Paper for 200 marks. The Paper will consist tests of:

- General Awareness

- English Language

- Quantitative Aptitude and;

- Reasoning

Candidates have to secure minimum marks separately for each test as well as in aggregate to qualify for Phase 2 exam.

Name of Paper | Type of Paper | Time (Minutes) | Marks |

|---|---|---|---|

Paper-I: Economic and Social Issues | 50% Objective Type 50% Descriptive, answers to be typed with the help of the keyboard | 30 +90 Total-120 | 50 + 50 Total-100 |

Paper II: English (Writing Skills) | Descriptive, answers to be typed with the help of the keyboard | 90 | 100 |

Paper-III: Finance and Management | 50% Objective Type and 50% Descriptive, answers to be typed with the help of the keyboard | 30 + 90 Total-120 | 50 + 50 Total-100 |

For both Paper I and III, there will be 30 questions and 50 marks for Objective questions (some questions carrying 2 marks each and some carrying 1 mark each). In case of Descriptive questions, 6 questions will be asked, of which candidates will be required to attempt 4 questions (2 of 15 marks each (with difficulty level) and 2 of 10 marks each). In case, candidate answers more than 4 questions in descriptive, first 4 shall be evaluated.

Candidates will be shortlisted for the interview, based on aggregate of marks obtained in Phase-II (Paper-I +Paper-II +Paper-III). The minimum aggregate cut off marks for being shortlisted for Interview will be decided by the Board in relation to the number of vacancies. Roll No. of the candidates shortlisted for interview will be published on RBI website at appropriate time and interview call letters will be sent on registered email ID. Interview will be of 75 marks.

Get in touch

©2023 Crackgradeb™. All Rights Reserved.

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)

.png)